In that case, if previously the supply of corn was 50,000 kg., with a price of production of £2 per kg., and this satisfied a demand of 50,000 kg., at that price, we might now assume that, at this price of £2 per kg., demand is 52,000 kg. This additional demand will spur additional supply, and whether this results in lower or higher prices of production/market price, with further effects on the interaction of supply and demand will depend on whether this new supply itself is more or less efficient than the average.

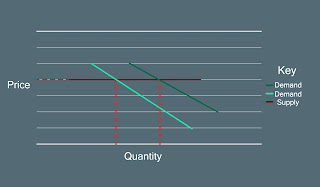

If we refer that same situation back to industry then we might have a similar shift in the demand curve for yarn, so that now there is demand for 52,000 kg. of yarn at a market price of £2 per kg. In order to meet this demand, additional supply is required. But, if we assume the situation that Marx did in relation to agriculture, we might assume – as Ricardo does, and as the marginalists do – that there is falling marginal productivity. Then, this additional 2,000 kg. could only be produced at an above average cost, so that the price of production for yarn rises, say to £2.10 per kg.

At this new price of production, demand is reduced below 52,000 kg., but remains above 50,000 kg., and is balanced by supply, let us say at 51,000 kg. At this new higher price of production, the new more costly production makes average profit, whilst all of the previous production, which made average profit at £2 per kg., now makes a surplus profit of £0.10 per kg.

It is not that productivity in agriculture does not rise, Marx says, but that it rises more slowly than in industry, with the consequent effect that there is a relative fall in productivity, which also means that values fall more slowly in agriculture, causing a rise in agricultural prices relative to industrial prices. This was the basis of the so called “scissors crisis” experienced in Soviet Russia in the 1920's.

It was also this which led Ricardo into error, however, in relation to his theory of the law of the falling rate of profit. Ricardo, like Malthus, believed that an increasing working population, as capital expanded, would require increasing amounts of food. But, this relative difference in agricultural productivity, compared to industrial productivity, would mean that agricultural prices would necessarily rise, causing wages to rise. This rise in wages would then continuously reduce the rate of profit, as the mass of profit was squeezed.

No comments:

Post a Comment